Mid-term Business Plan

18/05/2023

Leveraging our people and technologies to continue to succeed in a time of change

We established and announced the “2023 Mid-term Business Plan” for the three years from fiscal 2023 to fiscal 2025, and we developed a management plan by backcasting based on what we should be in 2030.

In addition to resolving the financial and nonfinancial issues that remained after the 2020 Mid-term Business Plan, which ended in FY2022, the 2023 Mid-term Business Plan identifies four basic policies.

- 1Enhancing our earnings capabilities

- 2Growing strategic businesses

- 3Investment in human resources

- 4Sustainability management

We will improve the enterprise value and achieve sustainable growth by strengthening “profit generating capabilities” and “development” of strategic business as the plan sets forth.

Realizing sustained growth through aggressive management in strategic businesses

Realizing increased corporate value and sustained growth by promoting enhancement of the earnings capabilities of core businesses and growth of strategic businesses

“Leveraging our people and technologies to continue to succeed in a time of change”

Net sales

220

billion

ROE

10%

Payout ratio

30%

or higher

Composition of strategic businesses

50%

Proactive environmental response

GX

Investment targets through 2030*

75

billion

- *capital investment and M&A

Enhancing core businesses and growing strategic businesses

Generating cash from core businesses and actively investing in strategic businesses expected to grow in the future

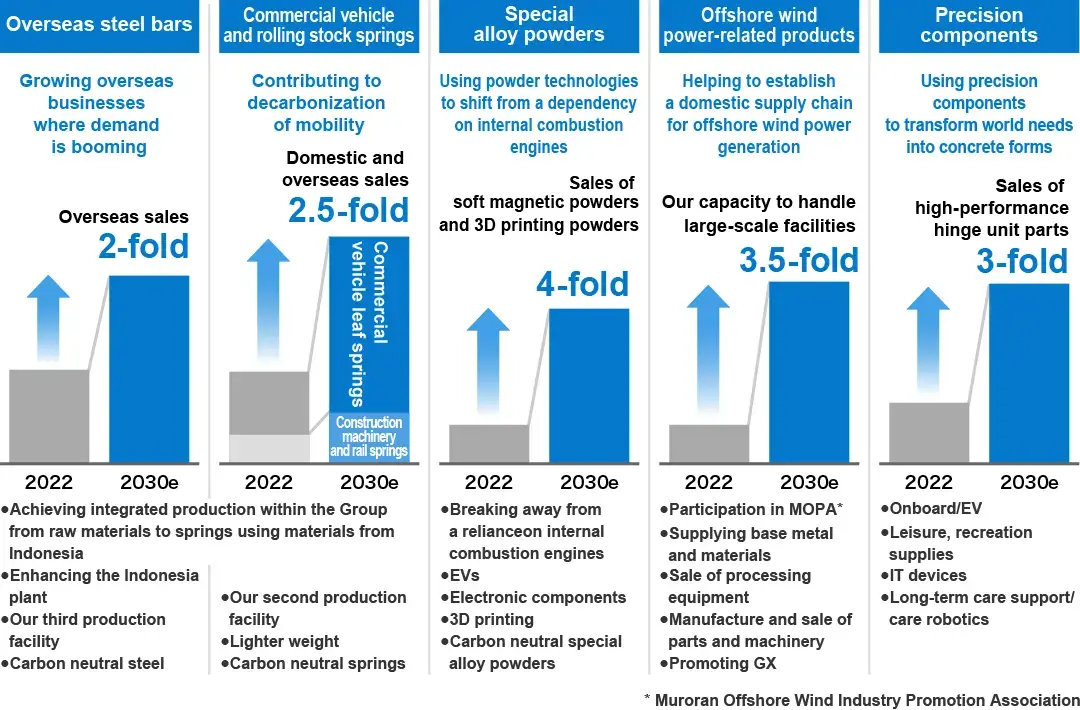

Main initiatives to grow strategic businesses

Targeting rapid growth in strategic businesses based on the key themes of the environment, overseas businesses, and the shift toward EVs

2023 Mid-term Business Plan

Serving as a milestone to achieve our ideal vision for 2030, the 2023 Midterm Business Plan is intended to realize growth in profits and enhancement of our financial standing while preparing for the next stage of rapid growth. We will implement the plan based on four basic policies.

- 1Enhancing our earnings capabilities

- 2Growing strategic businesses

- 3Investment in human resources

- 4Sustainability management

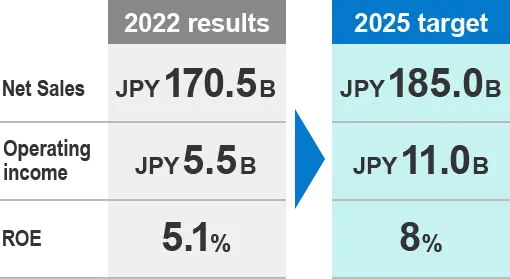

Financial and nonfinancial targets

Four basic policies

Pursuing enhanced earnings capabilities by cutting costs while maintaining and growing profit margins, we will use the resulting earnings to fund growth in strategic businesses and enhance our financial foundations.

Securing profit margins

- Prioritizing maintenance and growth of profit margins

- Increasing product added value by enhancing products developed jointly with customers

- Increasing customer satisfaction through means including use of digital technologies to shorten lead times for providing quotes and expansion of EDI transactions

Cutting production costs

- Cutting design and prototyping labor costs using digital technologies and saving labor through means such as use of IoT at plants and automation of manufacturing processes.

- Expanding plant improvement activities from domestic to overseas plants

- Promoting thorough streamlining of operations and control of fixed costs

- Also considering consolidation and closure of facilities

Enhancing product capabilities

- Developing and bringing to market high-quality steel bars for growth fields (e.g., offshore wind power, EVs)

- Continuing to bring to market products such as even lighter springs (particularly for use in high-end vehicles and EVs) and ones that can contribute to decarbonization

Reviewing product portfolios

- Considering changes in the product portfolio by verifying the future potential of markets, the profitability of products, and their business potential

We will promote growth of strategic businesses through active allocation of management resources to them.

During the period of the 2023 Mid-term Business Plan, we will shift course toward business growth to achieve large-scale growth in these businesses toward 2030.

Investment of management resources

- Allocating people, property, and funds toward environmental solutions, the EV shift, and overseas businesses

- Investing in increasing production at JATIM, which is operating at full capacity, and in the special alloy powders business, and promoting capital investment toward production of largescale products

Structure for creating new businesses

- Adopting a program for taking on the challenges of new business development, as a practical training program

- Adopting an internal startup program through fielding wide-ranging ideas

Enhancing testing and research

- A large-scale shift toward ESG-related R&D

- Acceleration using digital transformation tools and AI

Initiatives toward 2030

- Studying investment in facilities as a follow-up to the JATIM-leaf spring cooperative model, which is generating synergies

- Studying efforts to bring to market carbon-neutral steel bars, springs, special alloy powders, etc.

- Studying domestic production of machinery related to offshore wind power generation

We will boost productivity and realize innovation by investing in human resources.

Creating workplace environments for leveraging our people

- Transformation into an organization characterized by high levels of time performance through digital transformation (DX) and operational streamlining

- Building a more comfortable working environment by enhancing paid vacations, childcare programs, etc.

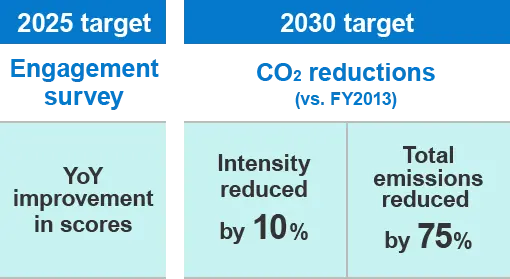

- Enhancing and improving efforts to learn about employee satisfaction through engagement surveys

Developing systems for leveraging our people

- Reviewing HR evaluation systems to increase employee motivation and eagerness to take on new challenges (enhancing feedback from evaluation and promoting the internal startup program)

- Providing opportunities for reskilling based on HR requirements (supporting lifetime learning)

- Developing autonomous human resources (improving HR quality) by enhancing programs that support earning official qualifications

Flexible creativity powered by diverse human resources

- Developing workplaces to enable more women to work in plants and training to promote women in the workplace

- Leveraging diverse knowledge and ideas through active midcareer hiring

- Realizing global exchange of human resources through means such as employing staff hired overseas in Japan

Increased investment in human resources (education, support for earning official qualifications, enhancement of employee benefits)

- JPY500M over the three-year period of the Mid-term Business Plan

Promoting sustained increases in corporate value by making clear ESG and other nonfinancial topics

Carbon neutrality initiatives

- We will aim to reduce CO2 intensity by 10% in 2030 in the steel bars segment, and also aim for carbon neutrality in 2050 by enhancing the CO2-free infrastructure.

- In other segments, we aim to reduce CO2 emissions by 75% in 2030 through expanded use of CO2-free electricity. (The previous target was a 50% reduction.)

- We also aim to contribute to decarbonization of the supply chain through means including studying carbon neutral products and supplying products to help reduce CO2 emissions at customer plants.

Promoting a digital transformation (DX) strategy

- Development of digital human resources (training data scientists)

- Manufacturing DX (plant visibility/automation)

- Sales DX (sales support systems/EDI enhancement)

- Business efficiency DX (use of RPA/updating the purchasing system)

Toward sustained growth and increasing corporate value

- Contributing to solutions to social challenges through social contribution activities and employee health and safety

- Incorporating into executive compensation nonfinancial incentives in addition to those toward Mid-term Business Plan financial targets

- Releasing updated TCFD disclosure on May 18