Corporate governance

Recognizing the importance of establishing a corporate structure capable of responding to any changes in business conditions, the Group has adopted sustained global growth based on development of competitive strengths in businesses as its fundamental management policy. For this reason, we regard as vital efforts to enhance corporate governance and carry out swift and reasonable management decision-making while securing functions related to checks and balances.

Corporate governance structure

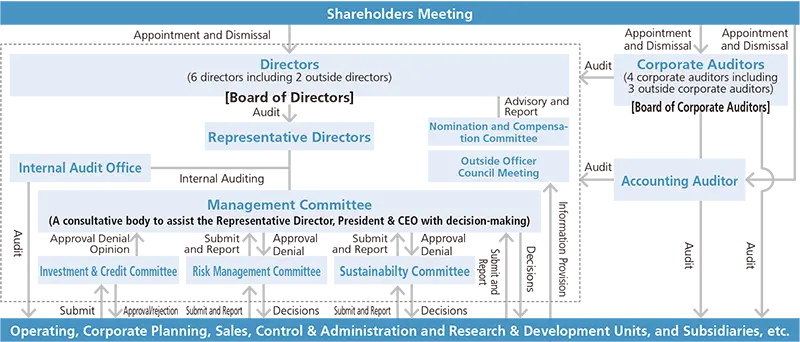

To fulfill our social responsibilities as an enterprise trusted by society, in addition to establishing the Corporate Philosophy, Mitsubishi Steel Group Code of Conduct, and Detailed Rules for Mitsubishi Steel Manufacturing Group Corporate Code of Conduct, we established our Basic Policy for Corporate Governance, which enhances programs that seek to achieve effective corporate governance. Our corporate governance structure seeks to enhance the functions of the Board of Directors and the Board of Corporate Auditors and to strengthen oversight of business execution, compliance, and risk management through the Management Committee.

In addition, the Company further enhanced the operations of the Nomination and Compensation Committee established in FY2022. Specifically, in the area of nomination it clarified executive requirements, selection standards, and procedures, as well as enhanced its succession-planning efforts through selection, development, and evaluation of candidates for executive positions. In the area of compensation, it reformed the executive remuneration system by adopting nonfinancial environmental, social, and governance (ESG) indicators in addition to the existing financial indicators on which compensation has been based. The Company remains committed to continuing to enhance its corporate governance structures.

| 2015 | ・New Governance Committee established ・Basic Policy for Corporate Governance established |

|---|---|

| 2016 | ・New Investment and Credit Committee established ・Assessment of efficacy of Board of Directors launched ・Board of Directors meeting held at business sites |

| 2019 | ・SR activities launched ・Risk Management Committee established |

| 2021 | ・Principle adopted to ensure Outside Directors account for at least one-third of the Board of Directors members ・Term of office of Directors reduced from two years to one ・Executive officer system adopted ・Sustainability Committee established ・Cross-shareholdings reduced (from 15% to 4% of net assets) |

| 2022 | ・SR activities enhanced (participation of Outside Directors) ・Women's share of executives increased to 20% with appointment of two new women executives ・New Nomination and Compensation Committee established |

| 2023 | ・Roles and name revised with transition from Governance Committee to Outside Officer Council Meeting |

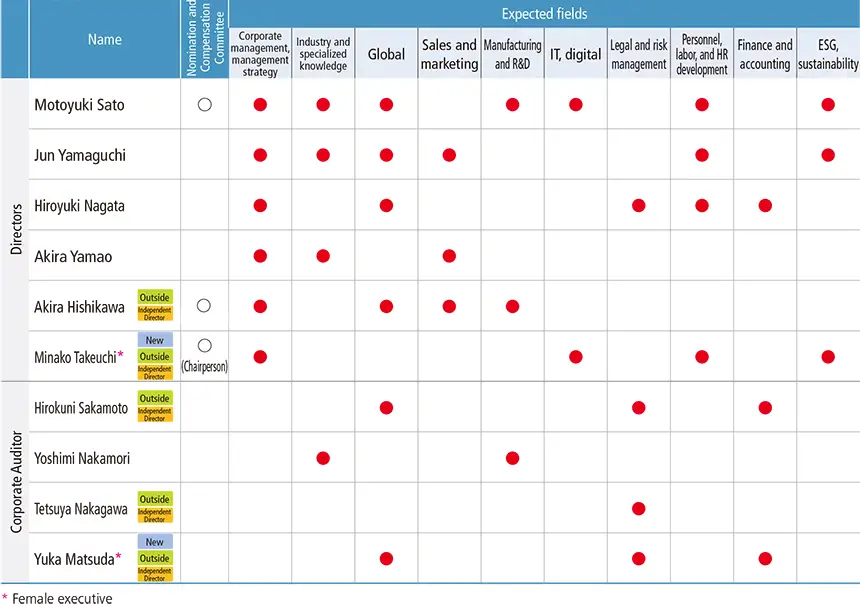

Thinking on Board of Directors balance, diversity, and size

For the Board of Directors, we seek to strike a balance between size and diversity based on a membership structure that accounts for range of experience, knowledge, and abilities, including international considerations. The number of members is maintained at the necessary minimum to enable swift, decisive, effective decision-making. In addition, we secure fairness and transparency in Boardecision-making by appointing Outside Directors for at least one-third of the membership.

A Skills Matrix presenting the knowledge, experience, abilities, and other properties expected of each Director and Corporate Auditor is shown below.

Executive remuneration

(1) Basic policy on determining executive remuneration

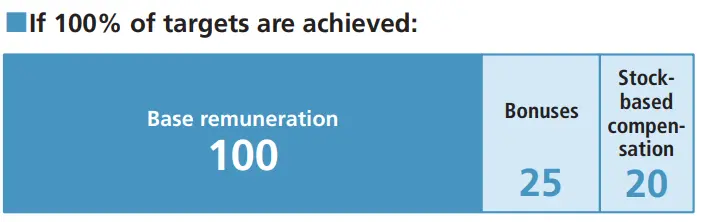

The Board of Directors sets the policies for determining executive remuneration. Remuneration for Directors other than Outside Directors consists of a fixed base remuneration corresponding to the Director's position, as well as bonuses and stock-based compensation.

Since Outside Directors are appointed to provide advice based on broad-ranging knowledge and experience, they are paid a fixed base remuneration reflecting their roles and responsibilities.

Detailed decisions concerning remuneration for each Director are entrusted to the Representative Director, President & CEO. To ensure the appropriate exercise of this authority by the Representative Director, President & CEO, the Board of Directors is advised by the Nomination and Compensation Committee, a majority of whose membership consists of Outside Directors.

(2) Indicators related to remuneration, reasons for selecting these indicators, and how actual remuneration is determined

Bonuses

| Indicators | Amounts paid are determined using payment ratios reflecting the indicator of business results (consolidated operating income) on a single-year basis and achievement of ESG indicators (such as CO2 emissions reductions) along with the extent of improvements in business results from the previous year and are adjusted for individual evaluations. |

|---|---|

| Reason for selecting the indicators | To strengthen motivation to achieve steady increases in annual company earnings and to achieve ESG-related goals that are identified as one of the basic policies under the Mid-term Business Plan. |

Stock-based compensation (non-monetary remuneration)

The Board Incentive Plan (BIP) Trust was adopted to incentivize improvements in business results and boost corporate value over the medium to long term.

| Indicators and reasons | Growth in the scale of business, improvements in profitability and capital efficiency, and achievement of ESG targets strengthen corporate value over the medium to long term. Based on this perspective, progress toward the Mid-term Business Plan's targets for consolidated net sales, consolidated operating income, ROE, sand ESG goals are used as performance indicators. (2023 Mid-term Business Plan targets) In the final fiscal year of the plan (FY2025): consolidated net sales of JPY185 billion, consolidated operating income of JPY11 billion, and ROE of 8% ESG indicators (e.g., CO2 emissions reductions) |

|---|---|

| Payment method | At the end of the period covered by the Mid-term Business Plan or upon the executive's retirement, shares corresponding to 50% of the number of points calculated based on points allocated annually to each position multiplied by a performance-linked coefficient varying in the range 0-200% depending on the extent of achievement of the indicators are awarded. The remainder is paid in the amount equivalent to the conversion price of the shares. |

Analysis and assessment of the Board of Directors

As the Company strives to improve corporate governance, it analyzes and assesses the efficacy of the Board of Directors annually based on evaluations by each Director and Corporate Auditor to determine whether the Board of Directors has effectively fulfilled its roles.

(1) Progress on implementation in FY2022

As was the case last year, assessments were conducted through the following evaluation process, based mainly on the methods of operating the Board of Directors, deliberations in the Board, and the structure of the Board, among other perspectives.

- Self-assessments based on surveys of all Directors, including outside Directors, and all Corporate Auditors, including outside Corporate Auditors

- Individual interviews with only outside Directors and outside (part-time) Corporate Auditors

- Discussion in the Board of Directors and the Governance Committee based on survey results

- Decision by the Board of Directors on the assessment of the Board of Directors based on these self-assessments, discussions, etc.

The results of this assessment of the Board of Directors indicate no serious concerns or other issues in FY2022 with regard to the effectiveness of the Board of Directors. The assessment points to no concerns with regard to the operations, deliberations, or structure of the Board of Directors. As a whole, the Board of Directors functions effectively.

The state of progress on addressing issues identified in assessment for last year (FY2021), issues identified this year (FY2022), and future countermeasures are reviewed below.

(2) Progress on addressing issues identified in assessment for last year (FY2021)

Issues identified for FY2021

- 1To enhance discussions in the Board of Directors, we will make the progress of the Mid-term Business Plan and sustainability a scheduled agenda item. We will also make operational improvements that deepen the understanding of Outside Directors with regard to the formulation of the new Mid-term Business Plan.

- 2We will enhance the oversight functions of the Board of Directors by establishing a Nomination and Compensation Committee independent of the Governance Committee.

- 3Efforts will seek to increase corporate value over the medium to long term by developing core management and securing the necessary skills through the steady implementation of a human resource development plan.

Addressing issues identified for FY2021

- 1We enhanced discussions in the Board of Directors by making the progress of the Mid-term Business Plan and sustainability a scheduled agenda item in each month in principle, excluding months of settlement of financial results. We also enhanced discussions through prior briefing on materials for Board meetings, to deepen the understanding of Outside Directors with regard to important topics including the Mid-term Business Plan and sustainability.

- 2The Nomination and Compensation Committee, which meets monthly, was established. This has enhanced processes in the areas of nomination and remuneration.

- 3A human resource development plan was formulated, and various measures based on the plan are being implemented steadily.

(3) Major issues identified this year (FY2022) and future countermeasures

- 1We will enhance discussions to contribute to future progress, including new businesses.

- 2In human-resource management, we will develop specific individual measures such as those aiming to enhance hiring, improve retention, and allocate human resources strategically.

- 3We will consider the roles and name of the Governance Committee, since its responsibilities for sharing information among outside Directors and advising on nomination and remuneration have been transferred to the new Nomination and Compensation Committee.

We will strive to ensure that the Board of Directors functions effectively through timely future improvements in these areas, as well as by assessing their results and making further improvements.

Key items related to internal control

Enhancement of the functions of the Board of Directors and the Board of Auditors systems

The Board of Directors is a forum for directing the overall management strategy of the Group, and while ensuring swift decision-making, it formulates basic management policies, decides on matters stipulated by laws and regulations, the articles of incorporation, and other important matters related to management, and supervises the execution of duties by directors. In addition, outside directors and outside auditors attend the Board of Directors meetings, ensuring fairness and transparency in decision-making regarding business execution.

In addition, in order to pursue more effective corporate governance, we strengthen the supervisory function of the Board of Directors by exchanging information and sharing understanding among independent outside directors at the Outside Officers Liaison Council, which is a sub-organ of the Board of Directors.

Strengthening of compliance with laws and regulations and crisis management through deliberations on business execution at management meetings

We hold regular weekly management meetings composed of directors, auditors, and executive officers, where we deliberate and respond to important business execution, compliance with laws and regulations, and crisis management.

Internal control over financial reporting

The Internal Control Committee and the Board of Directors have evaluated that the internal controls related to financial reporting for fiscal 2022 are effective in accordance with generally accepted evaluation criteria. In addition, we have received an audit opinion from the audit corporation that this evaluation is appropriate.

Strengthening of the internal control system

We review the "Basic Policy on Internal Control" every year and make resolutions at the Board of Directors' meetings, and disclose the status of its operation in our business reports.